Synopsis

Market power refers to the ability of a state or the EU to leverage the attractiveness and size of its domestic consumer or financial market to extract concessions from other states or private actors. Foreign actors that fail to comply with the preferences of such a state risk being denied market access or facing higher operating costs. Some markets—such as those of the US and the EU—are so large and influential that they are indispensable, and sometimes even vital, to foreign companies and financial institutions. This in turn compels the governments of these companies’ home countries to take those interests into account.

According to Barnett and Duvall’s typology of forms of power (Barnett & Duvall, 2005), market power can be understood as a form of compulsory power, since it operates directly and interactively between actors. When it reshapes the industrial landscape of other countries, however, one could argue that it also acquires a constitutive dimension, thereby amounting to a kind of structural power. The source of this power is material and lies in the size and attractiveness of the domestic market.

Below are three examples illustrating the use and effects of market power:

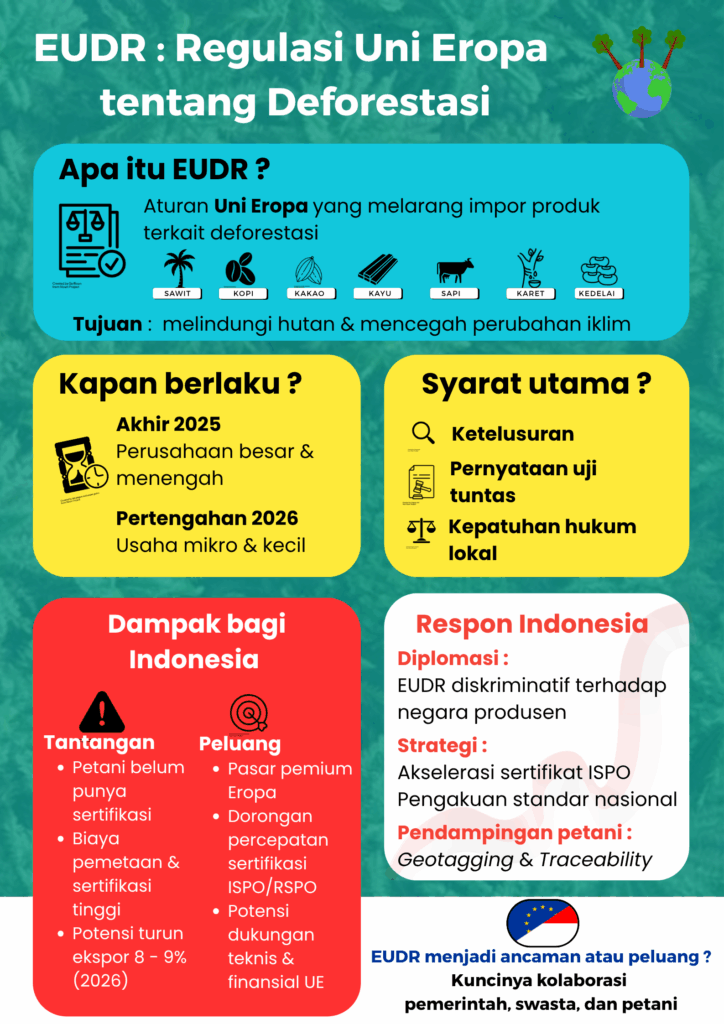

• The EU’s regulatory reach: The EU represents a market of 450 million consumers with high purchasing power. Companies worldwide are eager to export to the EU but must comply with its regulations, including environmental and sanitary standards. In this way, EU market power externalizes EU standards beyond its borders.

• David Vogel coined the term “California Effect” to describe this mechanism, referring to California’s policy of enforcing strict environmental standards for cars sold within the state, which compelled producers in other US states and abroad to comply with these standards. In general, the term suggests “the upward ratcheting of regulatory standards in competing political jurisdictions. […] Political jurisdictions which have developed stricter product standards often force foreign producers in nations with weaker domestic standards either to design products that meet those standards, since otherwise they will be denied access to its markets. This, in turn, encourages those producers to make the investments required to produce these new products as efficiently as possible. Moreover, having made these initial investments, they now have a stake in encouraging their home markets to strengthen their standards as well, in part because their exports are already meeting those standards” (Vogel, 1997). In other words, the California effect illustrates the use of market power.

• The US FATCA law: The US Foreign Account Tax Compliance Act requires foreign banks, including those in tax havens, to disclose financial details of US taxpayers. Non-compliant banks face heavy penalties if they operate in the large, liquid, and profitable US financial market (Lips, 2019).

• US tariff threats under Trump: The Trump administration leveraged the threat of steep import tariffs to pressure other countries into aligning with various US foreign policy objectives—knowing that losing access to the US market would be extremely costly. This is not a new phenomenon (James & Lake, 1989).

Some authors use the term not to describe a form of power, but rather to denote a country or bloc with a large market as a ‘market power’ (Damro, 2012).

Bibliography

Topics

Theories

About Course

pruba</….p>

What to learn?

Instructor